-1661325821.png)

Yvan Byeajee once said, "The expectation that you bring with you in trading is the greatest obstacle you'll encounter."

And... when it's about trading, most market traders have HIGH expectations, which are only natural human instincts.

Even though Forex is widely regulated and known, traders often face hesitation about whether to rely on it as a passive source of income or not.

Even though Forex is widely regulated and known, traders often face hesitation about whether to rely on it as a passive source of income or not.

Well, if you're well aware of all the knacks of the foreign exchange market and have effective trading strategies up your sleeve, then guess what?

You might nail it!

Now, about the trading strategy, the Fibonacci Forex Trading Strategy is a proven and well-known trading strategy without any doubt.

'Mastering the time and price advantage is the motive of the Fibonacci Forex trading strategy. For this, you need to know about Fibonacci and its working process.

If we look at a survey from 2022, we'll see that the forex market is worth around $2,409,000,000 ($2.409 quadrillion), and the daily volume is $6.6 trillion. It can't be lost in a massive market like this if it's not profitable.

Every trade goes through ups and downs. Suppose you are a risk taker and know when you need to stop or start trading for yourself.

In trading, patience is the most needed thing. Trading follows the proverb: "Slow and steady wins the race." If you are in a hurry, trading is not for you.

That being said, in this blog, I'll be shedding light on some crucial facts regarding the Fibonacci Forex trading strategy.

The Fibonacci number sequence is a certain calculated number used in trading, biology, chemistry, and to calculate the cosmos.

A set of numbers that are mathematically derived is the Fibonacci sequence.

Fibonacci Retracement Levels indicate significant price points.

If you divide a number by the last number, it will be approximately 1.618. This is used as a critical level in Fibonacci extensions.

Fibonacci important target levels- -0.272, -0.618,-1.618, etc.

Using Fibonacci Retracement, the price can consolidate, correct, make a range, and move sideways.

The correct place to use Fibonacci Retracement is between the ''swing high swing low''.

Golden PHI is equal to 0.618!! For this reason, 618 Fibonacci Retracement is so essential in Forex trading.

The 'hammer' and 'shooting star' are the most common price action trading patterns.

If you want to know what Fibonacci is, you must understand who Fibonacci is.

The actual name of Fibonacci is Leonardo Pisano Bigollo. He was born in Italy and was a great mathematician of the Middle Ages. He is well known for the Hindu-Arabic numeral system in Europe.

He became more popular after publishing his book Liber Abaci (Book of Calculation) in 1202.

For the ''Fibonacci number sequence'', Leonardo Pisano Bigollo is known as Fibonacci. It is not because he discovered the sequence himself, only because it was named after him.

The Liber Abaci used the Fibonacci number sequence as an example.

The numbers sequence is like 0,1,1,2,3,5,8,13,21,34,55,89,144, etc.

The trick here is to sum the first two numbers as the third one (0+1=1), and it continues by adding the 2nd and 3rd, which equals the 4th number (1+1=2), etc.

I think now you all know about Fibonacci. Having knowledge about it and implementing it is a different matter.

So, it is important to know what a Fibonacci trading strategy is and how Fibonacci retracement is used. But Fibonacci scalping strategy is also side by side useful.

The Fibonacci sequence is a set of numbers that are mathematically derived. This sequence of numbers starts with 1 or 0, and it maintains the preceding two numbers sum for the following number of that sequence.

If the Fibonacci sequence is for F (n), then 'n' is the first term in the sequence, and the equation is for n=0.

This number sequence maintains a simple equation like 1st one + 2nd one= 3rd, 2nd one + 3rd one= 4th, 3rd one + 4th one= 5th one etc.

When n=0, the first two terms are defined as 0 and 1 by default, and it's like F(0) = 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610...

An interesting fact about the Fibonacci sequence numbers is that it has a guide on thrust or impulsive movement of pips that is pretty effective, and it's for all legal currency pairs.

In Forex Trading, this sequence is very effective. Here lower Fib (Fibonacci sequence) numbers are for lower frames, and higher Fib (Fibonacci sequence) numbers are for higher frames.

The Fibonacci scalping strategy is ideal for making your consistent profit trading journey.

The horizontal lines that indicate where and when backing and resistance are perhaps to happen are Fibonacci retracement levels.

It originated in the early 13th century by following Fibonacci's sequence. This mathematical formula is beneficial in trading.

Percentages are linked with each Fibonacci Retracement level.

The percentage is related to the quantity of prior price moving.

The Fibonacci retracement levels are 23.6%, 38.2%, 61.8%, and 78.6%. Unofficially 50% Fibonacci ratio is also used. Many traders think that these numbers are very relevant in the financial markets.

The best part of this Fibonacci retracement level is the indicator of significant price points. It can draw a line between a high and a low point, creating the levels between the two points.

The best trading strategy and proper utilization are the keys to a successful trader.

Before interpreting Forex Fibonacci's trading strategy, we need to know about the mechanics of Fibonacci trading. Because it's essential for trading to know about the Fibonacci sequence and its unique mathematical properties.

Already we discuss the basics of the Fibonacci number sequence above. And following the Fibonacci sequence is important, as the number sequences are pretty important. But in Fibonacci trading sequence, support and resistance levels are plays a vital role.

There are interesting relations between the Fibonacci number sequence based on Fibonacci numbers trading.

Here we can't cover all relations in this article. Some most important necessary ones are mentioned below:

In 1975 William Hoffner told in the Smithsonian Magazine that- "The proportion of .618034 to 1 is the mathematical basis for the shape of playing cards and the Parthenon, sunflowers and snail shells, Greek vases and the spiral galaxies of outer space. In Fibonacci trading, multiple important things like Fibonacci ratio, Fibonacci numbers, and Fibonacci tools.

The Greeks based much of their art and architecture upon this proportion."

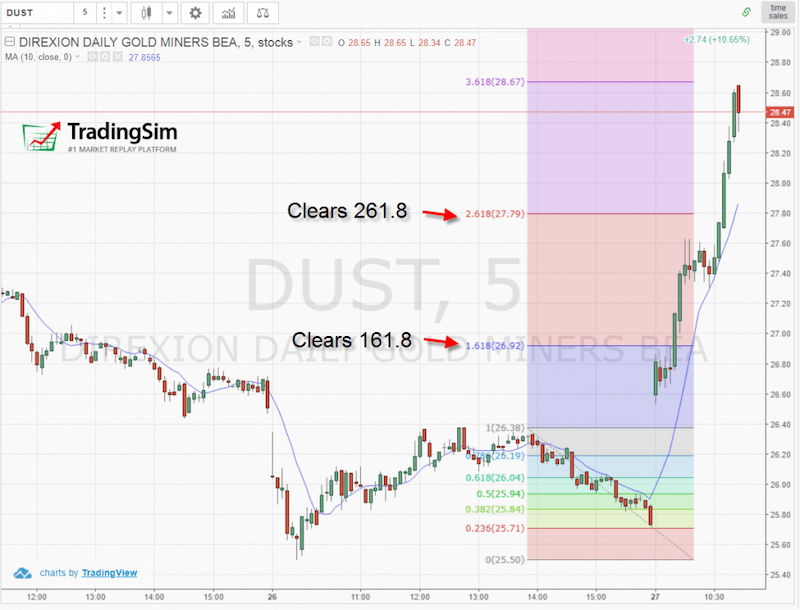

When the Fibonacci levels are used in trading, they divide these unique numbers into Fibonacci retracement levels and Fibonacci extension levels.

Then they provide values for the possible turning points of the market.

In short, this is a summary of how Fibonacci works in trading. There are more in-depth details about this topic in this entire blog.

The Fibonacci targets provide significant exits in a tread that's the reason for its popularity. The essential Fibonacci targets are:

There are also some other worthy Fib targets on the chart. These are mentioned below:

In your Fibonacci properties, you can add these targets by click, and after that, add these levels to your Fibonacci retracement tool.

Don't forget to add a minus sign (-0.180) before the number. That's why Forex Fibonacci levels are pretty conclusive.

This retracement level doesn't have any specific formulas. When indicators are used in a chart, the user chooses two points.

If anyone chooses the two points once, it draws a line between high and low points and shows the percentage for each market move.

An example: Think that the price rises from $10 to $15, and the two price levels and the points are used to draw the retracement indicator.

Then, the 23.6% level will be at $13.82 ($15 - ($5 x 0.236) = $13.82). The 50% level will be at $12.50 ($15 - ($5 x 0.5) = $12.50). These formulas can be identified by the Fibonacci sequence. And for applying that, you need a Fibonacci tool.

In Fib levels, no calculation is required. It's all about simple percentages of the chosen price range.

It is based on the ''Golden Ratio''. These numbers start with 0 and 1 and add every last two numbers. The sequence is like 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987... ∞

This number string drives the Fib retracement levels. When the sequence gets going, dividing one number by the next number yields 0.618, or 61.8%.

In a trading platform, nothing is certain. This market is continuously changing. Even if you are trading with a renowned forex broker. So being strategic and using some tricks is necessary. For this, these levels are precious to identify potential support.

Before using this Fibonacci retracement level tool in your trading, you must know which time is the best time to apply this in trading. These tools work best in trend markets. These don't provide any convenience in ranges.

Fibonacci retracement levels are simple and easy to use. Here the Fibs have no value in the zones where the price consolidates, corrects, ranges, and moves sideways.

It happens for the traders ignoring tend. Here currencies act and react to different tools like tops and bottoms.

It will be a profitable journey if the currencies are trading actually or the Fibs are used on the higher time frames because these tools give the best gesture of the market turning back to the channel of the trend. But it will be easy for you to follow the Fibonacci sequence to improve in support and resistance levels.

Fibs are easy to use. Traders will not require forex brokers, and the most important fact is proper utilization can be great for trading. Here, an investor can choose his entry, target, and stop-loss placement using Fibs, which depends on the Fibonacci Retracement tools.

But it's not tied-up rules, and investors can choose different ways to exploit Fibonacci numbers for their trading style.

Fibonacci levels can also filter out trade ideas. It opens great opportunities for traders.

Fib levels are important for those traders who don't want to go long or short in front of a big Fib level, and this situation can invalidate their trade ideas.

Fibs can show traders an exact path to enter a trade at the trigger point. A trader can have a certain Fib level in mind as per his trading strategy. They set up a plan to tackle this while entering the Fib level directly.

While trading forex, Fibonacci support level and Fibonacci ratios are both vital. But also, you have to remember that in foreign exchange trading, traders must use apply Fibonacci retracement levels to reduce the chance of a high risk of losing money rapidly.

These are not all, and a trader can choose candlestick patterns, break out, or any other confirmation that the price is respecting the Forex Fibonacci levels.

Forex trading is the most trendy trading platform all over the world. It's profitable, but with a Fibonacci Forex trading strategy, traders can go one step long because it provides more technical analysis for them.

Fibonacci Forex's trading strategy provides a price analysis that is very important for forex traders.

It offers a variety of price actions and patterns. Here traders can choose candlestick or bar formations chart. These levels give the area and price action to buy or sell currencies.

The most common price action trading patterns are the 'hammer' and 'shooting star' patterns.

The hammer pattern is a bullish signal that signifies sellers' failure to close the market at a new low and buyers surging back into the market to close near the high. So, however, you build up your fibonacci strategy, there always will be high risk of losing.

The shooting star pattern is the opposite of the hammer pattern. It's a bearish signal that signifies buyers' failure to close the market at a new high and sellers surging back into the market to close near the low.

Placement of the Fib retracement tool on the accurate top and bottom is the most important thing here to do. As a trader, I place the tool from left to right, but some traders do the opposite and place the tool right to left.

I think it's better to put the tool from the past to the current price. But traders can choose their decision that which way they want to go past to current or current to past and also can use it as further examples.

While Forex traders place their Fib in the exact position, it can be from the bottom to top in an uptrend and from top to bottom in a downtrend. Moving from top to bottom is also known as ''swing high swing low''.

In Fibonacci forex trading, correct placement is crucial because you can be fibbing the wrong leg of a move and facing a massive loss without it.

A few fundamental items traders must be aware of:

If you find a suitable confluence, it can be the reason for your success in Forex trading. Finding out multiple ways for trading is a cunning decision.

When a Fib target and a Fib retracement are lined up at the same price, the price reacting to it has substantially increased.

Waiting for a confirmation of price reaction to a Fib level is a great method of reducing risk and ensuring that the Fib placement you used is correct.

This is another great way of combining various technical analysis tools in the Forex market.

Last but not least, needless to say, moving averages or trend lines with Fibs is, of course, just as good as well.

In Forex trading, phi is an important element. Its also known as the golden ratio.

Two quantities in the golden ratio are like the ratio of the sum of the quantities to the larger quantity is equal to the ratio of the larger quantity to the smaller one. In math this means ((A+B)/A) = PHI.

The PHI is equal to 0.618!! For this reason, 618 Fib retracement is so important in Forex trading.

This number is important in Forex trading, and the Phi number can be seen in arts and even nature.

All Fib levels have equal importance, and if you know the value of these Fib levels, you will be on the footstep of succeeding through Fibonacci trading.

If it's enough for your learning, definitely you will face something interesting.

Fibs are the original beauty of trading. Golden Phi is an important part, and the targets can amaze you. So sit tight and work with the plans you fixed.

Pay attention to the targets you want to add to your Fibonacci retracement tool are:

These targets are amazing in a word. The market truly respects these levels.

These targets give you profitable trading, and you need not worry about when or how you need to take profit.

The market keeps repeating itself over and over. These are the levels you want to keep in mind.

Other important targets are:

You can add these targets by clicking on your Fibonacci properties and adding these levels to your Fibonacci retracement tool.

If you know the market and can utilize your opportunity, your journey in trading will be amazing.

You must realize that a new Fib isn't placed on a new swing high swing low unless the target has been hit. This happens for a simple reason.

When a currency pair is in trending mode, it hits the targets. While the currency bounces between the top and bottom, the currency is in a range. An experienced Forex trader places a new Fib only when it's on track.

The most important target to hit is -0.618 or -0.272 in the case of the 78.6% and 88.6% Fibonacci retracement levels.

To begin, you must identify security as a strong trend.

A stock with a strong trend has successive highs with less than 50% pullbacks.

If you trade as a day trader, look for this setup on a 5-minute chart 20 to 30 minutes after the market opens.

After identifying a strong uptrend, look at the time, sales, and Level 2 to see how the stock behaves around the 38.2 percent and 50 percent Fibonacci retracement levels from the morning highs.

Enter the trade when you notice the trading activity slowing or turning.

You can use the most recent high or Fibonacci levels as a target point for exiting the trade.

Notice how LGVN stays above the 38.2 percent retracement level before making a higher high in the chart above.

The chart above appears to be clean and secure. The reality is that you will most likely have a 40% - 70% hit rate, depending on your ability to follow the rules and manage your emotions.

As a result, you must be prepared for when things go wrong. The most common issue in a pullback trade is that the stock does not stop where you expect it to. It could retrace to a full 100 percent retracement or even go negative on the date.

I've traded the Nikkei in situations where the stock had a 15% or greater swing from the morning highs.

You can guard against this scenario by doing the following:

When traders talk about their 30 percent gain in one hour, penny stocks look great. However, it is brutal if you are on the other side of the trade. Trade stocks with high volume and volatility to make a living, but don't feel obligated to trade with the other gunslingers.

Examine your winning trades to see how long it takes you to turn a profit with 85 percent certainty.

This is your time stop, whether it is 5 minutes or an hour. If you only have a 15% chance of winning, simply exit the trade with a predetermined allowable loss percentage or at the market.

There will be blowup trades; there is no way around it. I don't care how good you are; the market will eventually bite you. Have a maximum stop loss figure in mind at this point. Whever, you choose in fibonacci trading, the retracement levels will make you suffer.

As a general rule, we prefer 10%. However, because we only use a small portion of the account size for each position, we maintain a total portfolio loss of less than 2%. With lower volatility stocks, this may only occur once or twice a year.

The point is that you must be prepared for the unavoidable.

Breakout trades fail at one of the highest rates in trading. We'll give you a few things you can do to improve your chances of things working out.

Fibonacci resistance level exist only after the price has cleared the 100 percent retracement and continues to rise.

You are looking for a stock clearing this extension level with volume.

It is not enough to simply purchase the breakout.

As a result, as the stock approaches the breakout level, make sure it has not retraced more than 38.2 percent of the previous swing. This increases the likelihood that the stock will rise.

The same can be said for pullback trades where things can go wrong. The only difference is that you are more vulnerable to risk because the stock may experience a deeper retracement because you are buying at the peak or selling at the low.

To mitigate this risk, use the same mitigation strategies described for pullback trades.

Fibonacci can be used in conjunction with your indicator of choice. Just be careful not to create a spaghetti chart.

Once the AUDUSD downtrend offered short setups with an interesting chart. It already had a 38.2 retracement level and an easy turning spot for downtrend continuation.

Looking at the 4-hour price action, it becomes clear that several candlesticks were struggling at the 38.2 Fibonacci retracement level, but bullish engulfing twins could have annulled the bearish signals.

Fibonacci trend line trading rules are mentioned below:

A: In 3 ways, it can be used in forex trading: Step 1 - Specify the direction of the market: downtrend.

Step 2 - On top, attach the Fibonacci retracement tool and pull it to the right and to the bottom. Step 3 - Keep an eye on the three potential resistance levels: 0.236, 0.382, and 0.618.

A: Nonetheless, Fibonacci studies don't give an enchanted answer for traders. Rather, they were made by human trading psychology trying to disperse vulnerability.

Thusly, they shouldn't act as the reason for trading choices. Most frequently, Fibonacci concentrates on work when no genuine market-main impetuses are available on the lookout.

A: Fibonacci retracements are frequently utilized as a component of a trend-trading strategy.

In this situation, traders notice a retracement occurring inside a trend and attempt to make generally safe passages toward the underlying trend utilizing Fibonacci levels.

A: Fibonacci analysis can improve forex execution for both short and long-haul positions, distinguishing key price levels that show stowed-away support and resistance.

A: The most famous Fibonacci Retracements are 61.8% and 38.2%. Note that 38.2% is frequently adjusted to 38%, and 61.8 is adjusted to 62%.

After a development, chartists apply Fibonacci proportions to characterize retracement levels and gauge the degree of a revision or pullback.

A: Any time the market creates a critical development, a Fibonacci can be applied to that day or week. I recommend utilizing an outline with 30 or hour-long candlesticks for this technique.

This is a great time frame for watching the market's every day swings and utilizing Fibonacci Retracement.

Revealed In 2022 Revealed In 2022 What indicators do professional traders use? |

I think this article is helpful to you. Following the description may bring your comfort zone with Fibonacci Forex trading.

You also can understand how to utilize Fibonacci Retracement levels in the MetaTrader platform and use the new Fibonacci Forex trading strategy with demo or live accounts.

I have to stop here because it's already a large article. I hope that all of you are having a great experience with the Fibonacci Forex trading strategy. Learn more