India is a great place to trade forex. The country has a rich history of trade and currency exchange.

Forex trading in India is becoming more and more popular. Thanks to the internet, it is now easier than ever for people in India to trade forex.

There are many different forex brokers available to choose from. So, how do you know which one is the best forex broker for India?

Here are some things to consider when choosing a forex broker: Regulation, Customer service, Platforms and tools, Fees and commissions, and the list continues...

Now let's look at some other facts as well!

India is one of the emerging markets for forex trading. The Reserve Bank of India (RBI) allows foreign exchange trading within certain limits and regulates it through the Foreign Exchange Management Act (FEMA).

Forex trading in India is growing rapidly, with more and more people interested in this lucrative market.

If you're looking for the best forex broker for India, there are a few things you need to consider.

First, ensure that the broker is regulated by the RBI. This will ensure that your broker follows all the rules and regulations the RBI sets.

Another thing to consider is whether the broker offers a good trading platform.

A good trading platform will allow you to trade quickly and easily, without any hassle. Make sure that the broker you choose offers a demo account so that you can try out the platform before committing to it.

Finally, make sure that the broker you choose offers competitive spreads. This will ensure that you get the best possible value for your money.

So, these are a few things to remember when choosing the best forex broker for India. Keep these factors in mind, and you're sure to find the right broker.

As mentioned earlier, Forex trading is legal in India. However, there are some restrictions imposed on Indian citizens by the Reserve Bank of India (RBI).

For example, Indian citizens are not allowed to trade in currency pairs that involve the INR.

Furthermore, RBI imposes restrictions on the amount of money that can be sent abroad.

These restrictions are meant to prevent money laundering and other illegal activities.

In general, Forex trading is legal in India as long as you follow the rules and regulations imposed by the RBI.

If you're looking for a good Forex broker that operates in India, we recommend AssetsFX. They are a regulated broker with a good reputation.

How to verify SEBI Authorisation?

The first step in determining whether a forex broker is authorised by the SEBI is to locate the registration number in the disclosure paragraph at the bottom of the broker's homepage.

Here is the main disclosure text from the website of Interactive Broker, Next, search up the FSP number on the SEBI website's financial registry to confirm that the broker is currently permitted in India.

Stop Loss is important for every trading strategy

When it comes to Forex trading, one of the most important things you can do is to set a stop loss.

A stop loss is an order you place with your broker to sell your currency if it reaches a specific price.

This is important because it helps limit your losses if the market goes against you.

There are a few different ways to set a stop loss, but the most important thing is to make sure that you have one in place before you enter a trade.

This will help protect your capital and limit losses if the market moves against you.

There are a few different ways to calculate your stop loss, but the most important thing is ensuring you leave enough room for the market to move.

If you set your stop loss too close to the current price, you could get stopped out of your trade before the market can move in your favour.

One way to calculate your stop loss is to use a percentage of your account balance. For example, if you have a $1000 account, you could set your stop loss at 2%.

This would mean that if the market moved against you and your currency fell to $980, your broker would automatically sell your currency, and you would lose $20.

If you're looking for the best forex broker for India, then you need to make sure that they offer a demo trading account.

This is important because it will allow you to test their platform and see if it's right for you.

India is a very different market than most, so you want to ensure that your broker can meet your needs.

A demo account also allows you to practice your trading strategies before putting real money on the line.

This is crucial, as it can help you avoid making costly mistakes.

Demo accounts are typically available for a limited time, so take advantage of them.

Finally, make sure that your chosen forex broker offers customer support that is responsive and helpful.

This is important, as you don't want to be left in the dark if something goes wrong. Good customer support can make all the difference in your trading experience.

Forex Brokers are not required to register with SEBI, although the majority of reputable brokers are registered with the Security Exchange Board of India. The registration number of forex brokers can be found at the bottom of their websites.

On NSE, BSE, and MSE, you can only trade INR-based currency pairs in India (Metropolitan Stock Exchange).

In India, there are only four INR-based currency pairs available: USD/INR, EUR/IND, GBP/INR, and JPY/INR. You can also trade F&O contracts on the EUR-USD, GBP-USD, and USD-JPY cross currencies. This is due to the fact that the cross currencies have corresponding INR pairs.

If you wish to trade in other foreign exchange pairings, such as the AUD (Australian Dollar), CHF (Swiss Franc), CAD (Canadian Dollar), or other currency pairs, you must open a forex account with an international forex broker.

Foreign forex brokers permit Indian citizens to open accounts and trade in many currencies, equities, indices, commodities, and even the most prominent cryptocurrencies.

Forex is the largest financial market with low margin requirements and tremendous liquidity. To trade forex, you need the finest forex broker account.

Before choosing a forex broker, you must understand the criteria for selecting a top forex broker in India.

OctaFX offers trading in 35 currency pairs, commodities, CFDs, indices, and cryptocurrencies.

The company is registered and governed by St. Vincent and the Grenadines law.

Opening an OctaFX account online requires a minimum deposit of $20.

The following deposit options are available: Neteller, Skrill, local banks, Bitcoin, UPI, and Paytm. You can also deposit and withdraw using Mastercard.

OctaFX provides you with a practice demo account, no deposit or withdrawal fees, and rapid trade execution.

You can trade-in

⇒ 35 currency pairs, for example, EUR/USD, GBP/USD and others

⇒ 2 Metals Gold & Silver

⇒ 10 Indices like Nasdaq and DowJones

⇒ 30 Cryptos including Bitcoin, Ethereum and Litecoin

Depending on your trading experience and platform preference, you can open one of the two following account types:

⇒ MetaTrader 4 account – for new Fx traders

⇒ MetaTrader 5 account – for experienced traders

However, the account must be maintained in either USD or EUR.

With a maximum leverage of 1:500 and negative balance protection, you can trade at higher limits.

To begin trading, novice FX traders can utilise the video training and the copy trading feature.

What I Like

⇒ 0% fee on deposits and withdrawals

⇒ Pay via Paytm and Bitcoins to make a deposit.

⇒ Trading in cryptocurrencies accessible cTrader ECN platform for automated (algorithmic) trading

⇒ Support Hindi language

⇒ Option to have a 100% Sharia-compliant account

What I Didn’t Like

⇒ Only 37 trading assets

FXTM is a brand of Forex Time Limited and is regulated by the Cyprus Securities and Exchange Commission (Cyprus), the Financial Sector Conduct Authority, and the South African Financial Services Conduct Authority (UK).

Over 2 million individual traders worldwide have faith in FXTM. Currency pairs, CFDs, equities, cryptocurrencies, precious metals, and commodities can all be traded.

MetaTrader (MT4) and MT5 trading systems provide for swift and safe transactions on web, desktop, and mobile devices.

FXTM does not have its own trading platform, but it does offer trading tools with MT platforms.

The tools are FXTM's pivot point strategy and trading signals, which support your trading approach.

Using FXTM Invest, novice forex traders can copy trades in real-time by following experienced traders.

FXTM accepts a variety of deposit options, including Visa, MasterCard, Maestro, Skrill, Neteller, WebMoney, VLoad, and bank transfers.

Even bitcoin payments and crypto wallets are supported by FXTM.

What I Like

⇒ FXTM Invest copy trading option

⇒ Variety of accounts with low minimum deposits

⇒ Leverage up to 1:2000

⇒ Negative balance protection

What I Didn’t Like

⇒ No proprietary trading platform

⇒ Up to max 300 pending orders allowed

eToro is governed by the Cyprus Securities Exchange Commission (CySEC), the Financial Conduct Authority in the United Kingdom (FCA), and the Australian Securities and Investments Commission (ASIC).

Multiple assets, such as global stocks, ETFs, cryptocurrencies, indices, commodities, and currencies, are available for trading. Available CFDs include currency pairs, indices, and commodities.

In order to practice methods and real-time trading, prospective traders can open a $100,000 virtual-money demo account.

eToro promotes social trading, in which traders share tactics and advice. In addition, eToro allows users to imitate other traders' orders and actions in real-time.

The minimum initial deposit varies from $50 and $10,000 dependent on regional and national legislation.

Depending on the product and account type, eToro offers leverage ranging from 2:1 to 30:1, as well as negative balance protection, so that you can trade comfortably.

What I Like

⇒ 2000+ instruments to trade

⇒ $100,000 virtual practice account

⇒ Copy-trading and social trading facility

What I Didn’t Like

⇒ Flat $5 withdrawal fees

⇒ Minimum withdrawal amount of $30

⇒ Crypto transfer & conversion fees

⇒ Leverage of 30:1

The International Financial Services Commission regulates XM Global Limited, a subsidiary firm of Trading Point Holdings Ltd. (Belize).

The other Trading Point group entities are regulated by CySEC (Cyprus), FCA (United Kingdom), ASIC (Australia), and DFSA (Dubai).

XM has approximately 2,500,000 traders from more than 196 countries. You can trade more than one thousand instruments across six asset classes, including 55 currency pairs, CFDs on major global indexes, commodities, stocks, metals, and energy.

MT4 and MT5 trading systems are available on all devices (Android, iOS, iPad, Mac, and PC) and on the web via MT Web Trader.

A demo account with a $100,000 virtual balance is available for novice forex traders to hone their skills.

Four account categories at XM offer negative balance protection.

What I Like

⇒ Demo account with $100,000 of virtual balance

⇒ Low minimum deposit Forex account

⇒ Negative balance protection

What I Didn’t Like

⇒ Max 200 open positions

⇒ No proprietary platform

Formula Investment House Ltd owns the trademark iForex, which is licensed and regulated by the BVI Financial Services Commission (British Virgin Islands).

The site enables CFD trading on currencies, cryptocurrencies, indices, stocks, commodities, and ETFs.

With over 900 tradable instruments and real-time charts, iForex trading platforms are mobile and web-based trading platforms.

One-click deal execution is advantageous for traders.

A minimum initial deposit of $100 is required to open an account. The account can be filled using VISA, Mastercard, Diners Club, Neteller, Jeton, Skrill, and wire transfers.

The educational tools provided by iForex include videos, books, and one-on-one training with a trading coach. Support is offered in more than 16 languages.

Depending on the assets, you can receive up to 1:400 leverage and negative balance protection.

What I Like

⇒ One-click deal execution

⇒ Education & support in over 16 languages

What I Didn’t Like

⇒ Withdrawal fees of $20

⇒ No MT4 or MT5 trading platform

AvaTrade is governed by the Central Bank of Ireland in Europe, ASIC in Australia, the Financial Services Agency in Japan, the British Virgin Islands Financial Service Commission, FRSA Abu Dhabi, and the South African Financial Sector Conduct Authority (South Africa).

You can trade on desktop, web, tablet and mobile-based trading platforms with

⇒ AvaTradeGO (proprietary trading app)

⇒ MetaTrader 4

⇒ MetaTrader 5

AvaTrade's trading assets include 1250+ Forex, Commodities, Indices, ETFs, Stock CFDs, and Cryptocurrencies.

AvaTrade offers online trading, information, and educational products in 14 languages.

AvaTrade margin accounts can be started with a minimum deposit of $100 in any of the four currencies (USD, Euro, GBP and AUD).

However, 100 GBP is just for British traders, whereas 100 AUD is only for Australian traders.

Credit cards and wire transfers can be used to fund your account. AvaTrade also supports e-payments through Skrill, Webmoney, and Neteller.

However, E-payment solutions are not available to Australian and EU businesses.

AvaTrade provides leverage of up to 1:400 with negative balance protection, ensuring that your account never falls below zero.

What I Like

⇒ Websites for trading in local languages

⇒ Negative balance protection

What I Didn’t Like

⇒ Leverage of 1:400

Alpari International has been in the foreign exchange market for 20 years, and 2 million people trade with them.

The Financial Service Commission – Mauritius is in charge of Alpari. It is a brand name of Exinity Limited.

Alpari has two trading platforms: MT5 and MT4. You can trade stocks, commodities, indices, cryptocurrencies, and metal assets in addition to forex.

With Alpari's copy trading program, new traders can copy a strategist's trades and get a share of a certain percentage of their profits.

You can fund the margin account using

⇒ Credit cards (VISA, Master or Maestro)

⇒ E-wallets (Neteller, Skrill, Webmoney, Vload)

⇒ Bank wire transfer

⇒ Using local transfer

What I Like

⇒ Leverage up to 1:1000

⇒ Minimum deposits starting from $5

What I Didn’t Like

⇒ No FCA regulation

⇒ No negative balance protection

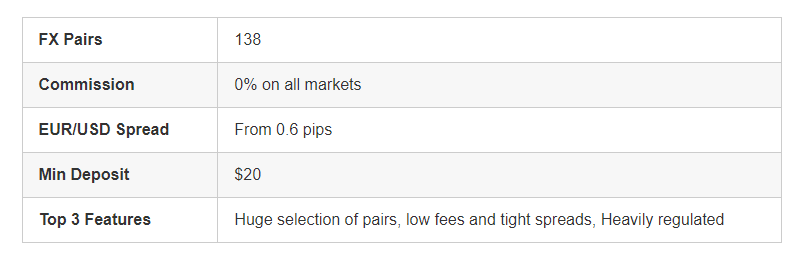

Capital.com is the clear winner as the best forex broker in India in terms of the markets it serves, the fees it charges, how it handles payments, and how it is regulated.

When you open an account and add money with an e-wallet or debit/credit card, you only need to put in $20. For bank wires, the minimum deposit is $250.

Almost 140 currency pairs will be available to Indian traders.

On the Capital.com platform, there are no fees and the spreads are very low.

There are no fees for either making a deposit or taking money out.

Capital.com gives Indian traders access to the forex markets through CFDs.

This lets them use leverage on their positions.

The Capital.com app for iOS and Android lets account holders trade online or through their phones.

It also works with MT4, which is good for traders with more experience.

Capital.com also has markets for indices, cryptocurrencies, hard metals, energies, and stocks.

Any supported market can be entered either by buying or selling.

The FCA, ASIC, CySEC, and NBRB all keep an eye on Capital.com.

This is one of the safest forex brokers in India, so it is one of the best. At Capital.com, you can also set up a practice account.

This can be opened for free and comes with a balance of $10,000 in it.

What We Like

⇒ Overall best forex broker in India

⇒ Trade forex with leverage

⇒ Regulated by ASIC, FCA, CySEC, and NBRB

⇒ Nearly 140 forex trading pairs

⇒ Great forex trading app

⇒ Also supports commodities, crypto, stocks, and indices

⇒ 0% commission and tight spreads

⇒ Buy Bitcoin CFDs in India with Capital.com

Libertex has the best forex trading app in India. Both iOS and Android users are welcome here, and it only takes a few minutes to set up an account.

With a debit/credit card or an e-wallet and the Libertex app, you can make deposits right away. The minimum deposit for new clients is just $10.

Libertex offers a wide range of major, minor, and exotic currency pairs, as well as stocks, commodities, cryptocurrencies, and more.

When trading major forex pairs, users will not have to pay any commission. Spreads start at 0.3 pips at Libertex, which is very competitive given that there are no fees.

Those who like to take more risks will like that Libertex offers leverage on all supported markets.

When it comes to trading tools, Libertex is compatible with both MT4 and MT5. This means that traders will be able to use customizable charts, economic indicators, and more.

There is also the main Libertex web trading platform, which can be accessed through standard browsers.

Demo accounts are also offered, and they come with $50,000 in fake money. Those who want to buy stocks in India can also use Libertex, since the platform gives access to real shares.

.png)

What We Like

⇒ Best trading app in India

⇒ Top MT4 forex broker

⇒ Advanced trading and analysis tools

⇒ Great selection of forex markets

⇒ 0% commission on major pairs

AvaTrade is the next company on our list of the best forex brokers in India to think about.

This broker can be reached through different platforms, such as MT4, MT5, and cTrader.

There is also AvaTradeGO and the AvaTrade web trader. This is the broker's own app for iOS and Android phones.

People like AvaTrade because its leverage limits are high and its trading fees are low.

In this case, AvaTrade is a broker that doesn't charge any fees. Spreads are usually very low here, and the EUR/USD pair starts at just 0.9 pips.

At AvaTrade, you only need to put down $100 to open an account.

There are no fees for making deposits or withdrawals, and both debit/credit cards and e-wallets can be used to pay.

There are 55 major, minor, and exotic forex pairs that are supported. Stocks, ETFs, indices, metals, cryptocurrencies, and energies are some of the other markets.

AvaTrade is regulated in eight different places, and the platform has a good name for keeping accounts safe. We also like that AvaTrade has tools for learning.

This lets people who are just starting out learn how to trade without taking too many risks. AvaTrade gives you a free demo account to help you learn more about trading.

.png)

What We Like

⇒ One of the best-regulated forex brokers in India

⇒ Compatible with DupliTrade

⇒ Leverage offered on all markets

⇒ Top MT5 forex broker

We found that Pepperstone is one of the best forex brokers in India for people who want accounts that are similar to ECN accounts.

Pepperstone's raw account gives traders access to the best rates on the market, so major forex pairs often have no spreads.

Traders who usually invest a lot of money will like this type of account.

On the other end of the spectrum, casual investors with less money to invest might like the standard Pepperstone account. Spreads on this start at 0.6 pips, but there are no commissions to pay.

Indian traders can open either type of account at Pepperstone without having to make a minimum deposit.

A bank wire or debit/credit card can be used to make a payment. Pepperstone's platform also has markets that aren't related to forex.

These include metals, energies, stocks, indices, cryptocurrencies, and more.

.png)

⇒ Raw spreads from 0 pips on major pairs

⇒ Supports some of the best forex trading platforms in India – including MT4/MT5

⇒ 0% commission accounts are also available

Forex.com is an online trading site where currencies are the main focus.

Indian traders will be able to buy and sell more than 80 pairs, and there will be two kinds of accounts available.

First, the standard account is good for investors who only want to trade occasionally through the Forex.com website or mobile app.

Second, there is an account that links directly to MT5. Both accounts are free of fees and have spreads that start at 1 pip and can change.

Forex.com is also one of the best Indian forex brokers for research and analysis.

This includes everything from information about the market and prices in real time to news about the economy and technical indicators.

Indian traders can also buy Bitcoin CFDs on Forex.com, as well as a number of other digital assets. Options, indices, stocks, commodities, and metals can also be traded with CFDs.

.png)

What We Like

⇒ Supports more than 80 currency pairs

⇒ One of the cheapest forex brokers in India

⇒ Great educational academy for beginners

XM is one of the best places for Indian investors on a budget to trade foreign exchange.

At this broker, there is a $5 minimum deposit for all account types. This can be paid for with a debit or credit card, a bank wire, or one of a number of other ways.

We like that XM lets you start with small deposits and gives you up to 1:1000 leverage on major forex pairs and less on other asset classes.

At XM, you only need 0.01 lots to make a trade. We also like that XM has made its own mobile app, which is free to download on both iOS and Android devices. MT4 and MT5 can also be used to trade online.

Fees depend on what kind of account you have. For example, the minimum spread on majors for swap-free, standard, and micro accounts is 1 pip.

With the ultra-low account, majors can trade as low as 0.6 pips, which makes it more competitive. There are no fees for any of the account types that can be used.

.png)

What We Like

⇒ Trade more than 55+ forex pairs at 0% commission

⇒ Spreads start from just 0.6 pips

⇒ 16 trading platforms across PCs, smartphones, and tablets

On our list of the best forex brokers in India, HotForex is another top platform you might want to think about.

We like that the broker offers more than 1,200 trading products, which include everything from forex and stocks to commodities and cryptocurrencies.

There are 15 ways to pay, including bank wires and debit/credit cards. The fees are also very low, but this will depend on the type of account you choose.

For instance, the raw account has no spreads on majors and a $3 per lot commission policy.

The minimum deposit for this type of account is $200, and the maximum leverage is 1:500.

A micro account might be better for traders who don't trade often.

This lets you trade foreign currency without paying any fees, and the spread starts at 1 pip.

The maximum leverage on the micro account is 1:1000, and the minimum deposit is only $5.

.png)

What We Like

⇒ Leverage limits of up to 1:1000

⇒ Account minimums start from just $5

⇒ One of the best forex brokers with low spreads

Forex Time, which is more often called FXTM, is an online broker that more than 4 million people use.

This platform gives users access to more than 1,000 markets, including forex, stocks, indices, and more. FXTM is known for how quickly it executes trades and how low its prices are.

There are different types of accounts to choose from. The micro plan only needs a $10 deposit.

No fees are charged for this account, and the spread starts at 1.5 pips. For the advantage account, you have to put down at least $500, and spreads start at 0 pips.

Depending on the number of trades, the average fee for this account is between $0.40 and $2. When it comes to making deposits, Indian traders can use UPI or Netbanking to add INR to their accounts.

There are no fees, and the money should be clear in 24 hours. Lastly, we like that FXTM's customer service is available through live chat, WhatsApp, Telegram, and Messenger.

.png)

What We Like

⇒ More than 1,000 markets supported

⇒ Deposit from just $10 to get started

⇒ 0% commission accounts offered

If you type "forex broker scams" into Google, you'll get a huge number of results.

Even though the forex market is slowly getting more regulated, there are still a lot of brokers who are not honest and shouldn't be in business.

When you want to trade forex, it's important to find brokers you can trust and work with, and to stay away from the ones that aren't.

Before putting a lot of money with a broker, we must go through a series of steps to tell the good ones from the bad ones and the trustworthy ones from the ones with shady deals.

Trading is hard enough on its own, but when a broker does things that hurt the trader, it can be almost impossible to make money.

⇒ If you don't hear back from your broker, it could be a sign that they are not looking out for your best interests.

⇒ Do your research, make sure there are no complaints, and read all the small print on documents to make sure a shady broker isn't trying to trick you.

⇒ First, try opening a mini account with a small balance and trading for a month before you try to get your money out.

⇒ Your broker may be churning if you see buy and sell trades for securities that don't fit your goals.

⇒ If you can't get rid of a bad broker, go over all your paperwork and talk about what you should do before taking more drastic steps.

When it comes to choosing the best forex broker for India, there are a few things you need to take into account.

The first is regulation. You want to ensure that the broker you're dealing with is regulated by a reputable body such as the Securities and Exchange Board of India (SEBI).

This will ensure that your investments are protected and that you're not being taken advantage of.

Another important factor to consider is the spreads offered by the broker. You'll want to make sure that the spreads are competitive, as this will have a big impact on your profits or losses.